greenville county property tax payment

You the user of this Website are responsible for insuring payments have been made funds settled and credit applied. Please Enter Only Numbers.

Voters To Select New Members Of Greenville County Schools Board Of Trustees Greenville Journal

Vehicle Registration click HERE.

. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. Please Enter Only Numbers. Your taxes are not paid until funds settle into our bank account.

Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601. Personal property returns cannot be filed electronically. Payments are accepted on-line via the Outagamie County Website.

Pay for a Bill. Greenville County Tax Collector SC. For vehicle registration property tax payments.

For a more refined search try including the first name i. Use My Location Powdersville. Welcome to the Tax Online Payment Service.

Prior to doing so look at what the appraisal actually does to your yearly tax payment. The State of Alabama Department of Revenue collects the Citys Sales and Use Tax. Pay Your Greenville County Tax Collector SC Tax Bill Online.

If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227. You are about to pay your Greenville County SC Property Taxes. It is your right to protest your propertys tax valuation.

To pay a violation you must have your invoice number or. The request must specify the identification page number that contains the social security drivers license state identification passport checking account savings account credit card debit card number or personal identification PIN code or passwords to be redacted. Median Property Taxes No Mortgage 982.

Greenville County Property Tax Payments Annual Greenville County South Carolina. Search Any Address 2. Need Property Records For Properties In Greenville County.

To begin please enter the appropriate information in one of the searches below. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050. Last name only is the preferred search method.

The payment processor will add the convenience fees to your total at checkout. This service allows you to make a tax bill payment for a specific property within your Municipality. Pay Here 220 convenience fee for credit card and 025 convenience fee for an e-check.

Ad Find Information On Any Greenville County Property. City of Greenville 119 E Commerce Street Greenville AL 36037 Phone. Vehicle taxes are paid twelve months in advance.

Please note that car dealerships do not collect county property taxes. Median Property Taxes Mortgage 1267. Village of Greenville Attn.

Property Tax Payment click HERE. Vehicle property taxes are based on the value of your vehicle and the tax district in which you live. Pay My Utility Bill.

In case of litigation it may make sense to get help from one of the best property tax attorneys in Greenville County SC. Once you locate your property using the search methods above simply click the Add button to the left of the. Get a Paid Property Tax Receipt for SCDNR Registration.

You can pay your property tax bill at the Tax Collectors department. Pay Your Greenville County Tax Collector SC Tax Bill Online. Property Taxes W6860 Parkview Drive PO BOX 60 Greenville WI 54942.

Pay My Tax Bill. See Property Records Tax Titles Owner Info More. Treasurer Tax Collector Offices near Greenville.

A 3 service fee minimum 200 will be added to your transaction. Pay by Phone for Property Tax. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050.

Before registering a vehicle in South Carolina you must pay personal property tax on your vehicle. 005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM. Once on the site click the Tax Bill Search tab and enter the required information.

Search for Voided Property Cards. The City of Greenville is accepting payment by credit card andor debit card for payment of utility bills property taxes and Violations. You can also pay online.

There is no fee for the redaction pursuant to request. 866-549-1010 Bureau Code 8488220 No title work after 345 pm in the Motor Vehicle Department. Located next to the inside drive-thru.

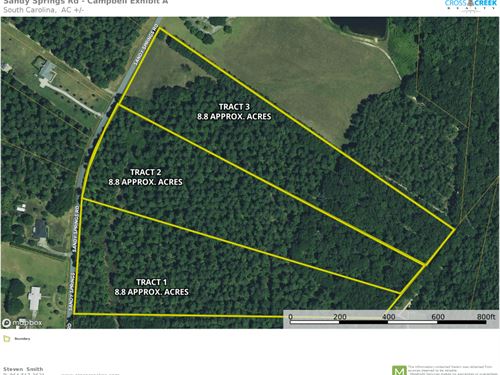

Why Land Values Are Rising In Greenville County South Carolina

How Healthy Is Greenville County South Carolina Us News Healthiest Communities

2022 Best Zip Codes To Buy A House In Greenville County Sc Niche

Greenville County Schools Incredibly Concerned Over Governor S Comments On Reopening Schools Greenville Journal

Greenville County South Carolina Farms For Sale Farmflip

Places Greenville County Housing Market Data And Figures

Women Making History In Greenville County United Way Greenville

Greenville County Schools Building Plans Ensure Facilities Keep Pace With Growth Greenville Journal

Greenville County Reveals Fresh Concept For Ongoing County Square Project Greenville Journal

Terms Greenville County Tax Collector Sc Online Payments

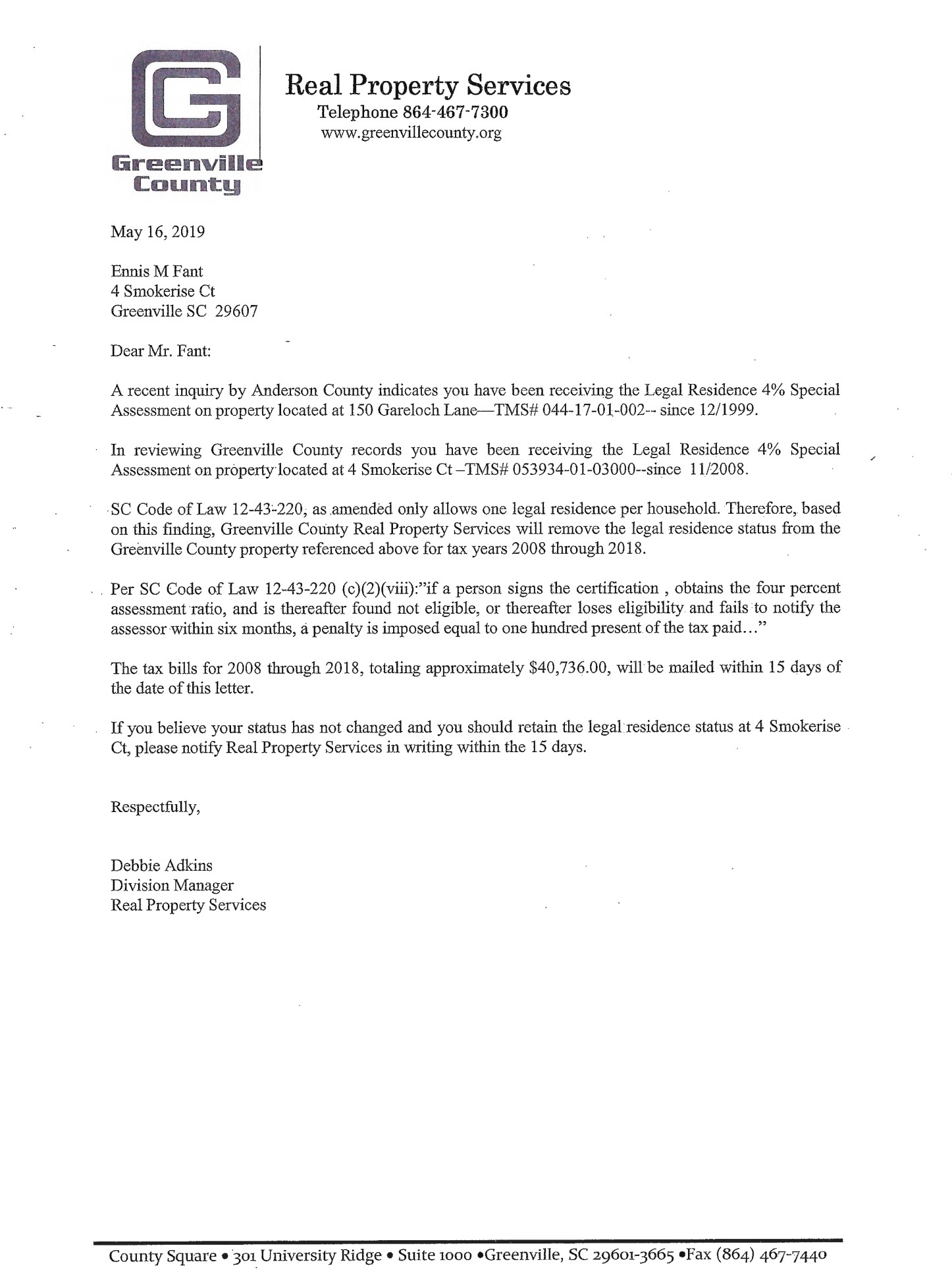

Greenville County Sc Councilman In Hot Water Over Taxes Fitsnews

The 2020 Election In Greenville County Gvltoday

How Greenville County Assesses Taxes The Home Team

Gcs Board Approves Fy 23 General Fund Budget

Maps Of Greenville County South Carolina

Women Making History In Greenville County United Way Greenville