www tax ny gov online star program

The following security code is necessary to prevent unauthorized use of this web site. Enhanced STAR is for homeowners 65 and older whose.

If you dont already have an account its easy to create one.

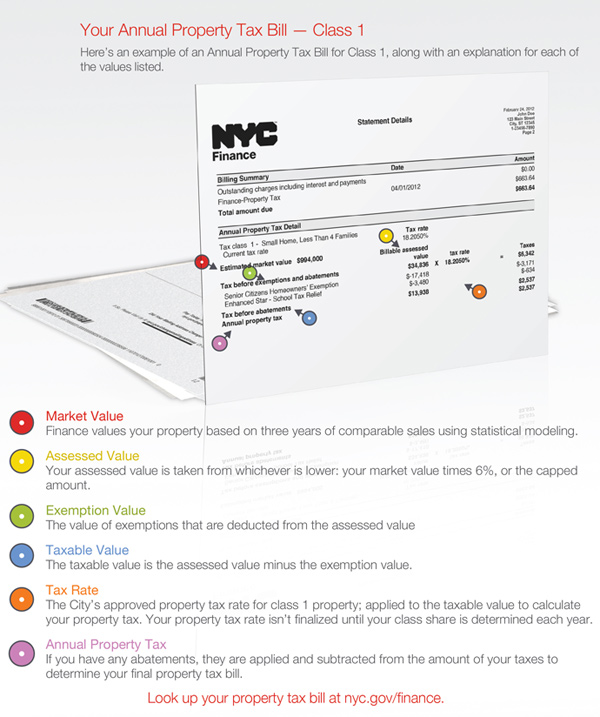

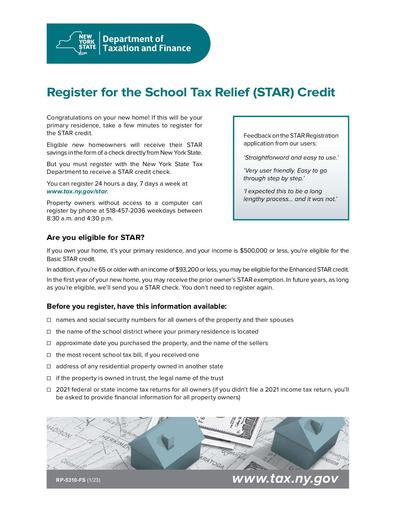

. The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes. The benefit is estimated to be a 293 tax reduction. We changed the login link for Online Services.

Your benefit may increase by as much as 2 each year. The following security code is necessary to prevent unauthorized use of this web site. New York State recently altered the STAR program lowering the maximum income limit for the Basic STAR tax exemption to 250000.

New applicants who qualify for STAR will register with New York State instead of. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. STAR property tax relief program Whats New.

STAR Check Delivery Schedule. Beginning with the October 20192020 school tax bill the state will automatically switch current Basic STAR tax exemption participants with a household income greater than 250000 and less than or equal to 500000. New York State Assembly Albany NY 12248 PRSRT STD.

If you are eligible and enrolled in the STAR program you. Receive your STAR check directly from New York State. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance.

IMPORTANT INFORMATION ABOUT NEW STAR PROGRAM CHANGES IMPORTANT INFORMATION ABOUT NEW STAR PROGRAM CHANGES The School Tax Relief STAR program provides eligible. Visit wwwtaxnygovonline and select Log in to access your account. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

With an Online Services account you can make a payment respond to a letter from the department and moreanytime anywhere. If you are a STAR recipient you receive the benefit in one of two ways. If you are using a screen reading program.

STAR exemption to register with the Tax Department in order to receive the exemption in 2014 and beyond Program applies to more than 26 million Basic STAR recipients Senior citizens receiving Enhanced STAR exemption are not impacted by this legislation All property owner questions should be directed to DTF at 518 457-2036 2. The Village of Freeport has no role in administering this program. STAR lowers property taxes for eligible homeowners who live in New York State school districts.

Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Online Services is the fastest most convenient way to do business with the Tax Department. Enter the security code displayed below and then select Continue.

There have been some changes in how certain homeowners will apply for STAR and in how they receive their STAR benefit. Enter the security code displayed below and then select Continue. Basic STAR is for homeowners whose total household income is 500000 or less.

US Postage PAID Albany NY Permit No. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now.

External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. Only available to homeowners who have been receiving the STAR exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill. NYS Form IT-201 Line 19 Line 9 STAR INCOME TOTAL NOTE.

The STAR program continues to provide much-needed property tax relief to New York States homeowners. If you are using a screen reading program. The STAR credit program open to any eligible homeowner whose income is 500000 or less provides you with a check in the mail from the New York State Tax Department to apply.

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Nys department of taxation finance rp-425e 2022-23 office of real property tax services application for school tax relief enhanced star exemption if you are not currently receiving the star exemption with the town of brookhaven do not file this form you must register with nys department of taxation finance. Homeowners may receive a greater benefit from NYS if they elect to switch from an exemption to a STAR creditcheck.

The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. The value of the STAR credit savings may grow by as much as two percent from year to year but the value of the STAR exemption savings being applied for via.

This State-financed exemption is authorized by Section 425 of the Real Property Tax Law. We recommend you replace any bookmarks to this. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR.

There are two types of STAR benefits depending on household income. Were processing your request.

Enforcement Actions Nys Joint Commission On Public Ethics

Nyc Residential Property Tax Guide For Class 1 Properties

Sean Mahar Seanmaharunreal Twitter

Sean Mahar Seanmaharunreal Twitter

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

The School Tax Relief Star Program Faq Ny State Senate

Rensselaer County Health Human Services Home Facebook

Chronically Online What The Phrase Means And Some Examples Phrase Meaning Human Relationship Internet Culture